Prices of international raw materials such as oil, gas, and grain, which are directly related to livelihood, are jumping further as the international supply chain disruption caused by the COVID-19 pandemic worsens due to Russian provocations.

Amid predictions that the global economy could shrink due to the U.S. austerity policy and China’s rapid economic slowdown, the war in Eastern Europe raises concerns about a “perfect storm.” The perfect storm is a combination of bad news and puts the economy in a major crisis.Prices have soared since the Ukraine crisis, and concerns over stagflation are growing again. Korea, where prices, exchange rates, and interest rates all jump, is no exception.

Shock accompanied by growth and prices…fear of stagflation with one’s head raised

Russia’s invasion of Ukraine is fueling the price of international raw materials, which is already on the rise, and the worries of each country are deepening.

According to Opinet, an oil price information service of the Korea National Oil Corporation, Dubai crude oil, Brent crude oil, and West Texas Intermediate (WTI) prices, which were around $70 a barrel at the end of last year, have all moved around $110 since exceeding $100 on the 2nd.

Wheat futures prices have jumped to the highest level in 14 years, and Dutch TTF natural gas futures prices, which represent the natural gas prices in the European market, have soared to the highest price in the market on the 2nd.

Russia’s share of the global economy (in terms of gross domestic product and GDP) is relatively small at 1.7%, but it is the world’s third-largest oil producer and accounts for 29% of the world’s wheat exports along with Ukraine. It is also a major supplier of other raw materials such as nickel and aluminum.

Europe relies on Russia for about 40 percent of its natural gas. Russian crude oil and natural gas are not yet subject to Western sanctions, but concerns over supply and demand are growing around the world, including Europe.

The National Institute of Economic and Social Affairs (NIESR), a British think tank, estimated in a report on the 2nd that this situation will lower the global economic growth by 1 percentage point by next year, raise prices by 3 percentage points this year and 2 percentage points next year.

Prices in each country are already rising, but inflationary pressure has increased due to the Ukraine crisis.Consumer price growth in the eurozone (19 countries using the euro) hit a record high of 5.8 percent last month compared to a year ago. Consumer prices in the U.S. rose 7.5 percent in January, the largest increase in 40 years.Reuters reported on the 3rd that soaring oil prices, the Fed’s hawkish tendency, and Russia’s invasion of Ukraine are reviving fears that stagflation in the 1970s could be reproduced in Wall Street, the world’s financial hub.Mario Centeno, a member of the European Central Bank’s top decision-making body, warned of possible stagflation in Europe. Fed Chairman Jerome Powell said at a Senate Financial Services Commission hearing on the 3rd (local time) that rising energy prices and shrinking consumption and investment due to the Ukraine crisis could hurt the U.S. economy.

On the previous day, Powell expressed his support for raising the federal benchmark interest rate by 0.25 percentage points this month, but he chose a modest increase in light of Wall Street’s prediction that he would raise it by up to 0.5 percentage points.Central banks in each country have to speed up raising the benchmark interest rate to curb soaring prices, but the risk of an economic downturn brought by the Ukraine crisis cannot be ignored.International oil prices have soared again in the wake of major oil-producing countries’ decision to increase production amid the prolonged war in Ukraine. On the New York Mercantile Exchange (NYMEX) on the 2nd (local time), West Texas crude oil (WTI) for April delivery closed at 110.60 dollars, up 7 percent (7.19 dollars) per barrel from the previous day. According to financial information company Factset, the closing price of WTI is the highest in almost 11 years since May 2011. The photo shows a gas station in downtown Seoul on the 3rd.

Prices are more unstable due to unstable domestic demand and exports in Korea and Japan.uncertainty weighting

Korea is also under the influence of the Ukraine crisis.

Although the scale of direct trade with Russia is not large, it is inevitably vulnerable to the price shock of international raw materials such as oil prices due to its highly dependent economic structure.

The trade balance has been in the red for the second consecutive month (December last year -430 million dollars, January -4.83 billion dollars) and the surplus in February (US840 million dollars), but the Ukraine crisis has made it unstable.The major aftermath of the Ukraine crisis is inflation.

Consumer prices rose 3.7 percent in March from the same month last year, marking the fifth consecutive month of the three percent range. Oil prices and food costs have boosted prices.If the war in Eastern Europe is prolonged or the level of Western economic sanctions against Russia increases, the price of raw materials will rise further and the international supply chain will be disrupted, further stimulating inflation.According to the Center for International Finance, Citigroup analyzed that a 10 percent rise in international energy prices could lead to a 0.17 percentage point drop in Korea’s GDP this year and a 0.24 percentage point rise in consumer prices, which could lead to stagflation.

In addition, special gas and palladium (semiconductor catalysts and plating materials) are highly dependent on Russia and Ukraine, which will increase the downside risk of the Korean economy if semiconductor production is disrupted.In January, industrial production (-0.3%) and consumption (-1.9%) fell together for the first time in 20 months, raising concerns over the possibility of an economic slowdown.In its revised economic outlook released on the 24th of last month, the Bank of Korea set the consumer price growth rate to 2.0 percent this year, sharply increasing to 3.1 percent. However, the forecast for economic growth remained at 3.0 percent. “We don’t have to exaggerate the crisis, but we have to be wary,” he said adding, “We expected economic growth to return to the normal path this year, but if growth weakens and prices rise higher than expected, stagflation can come.”

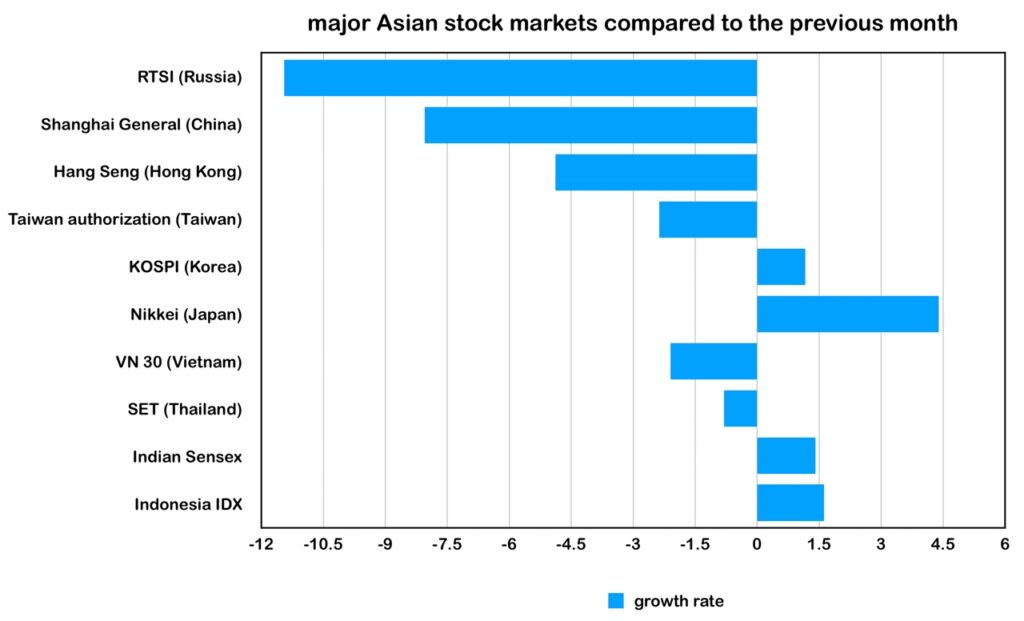

In addition, North Korea has launched ballistic missiles into the waters of Japan and South Korea one after another. The G7 and the Federation of Economic Power are discussing immediate economic sanctions, and it seems that the three Asian powers (Korea, Japan, and China) are looking at their independence and pursuit of national interests.

SAM KIM

ASIA JOURNAL