Sales of Japanese semiconductor manufacturing devices are expected to exceed 4 trillion yen for the first time this year.

According to foreign media such as Nikkei, the Japan Semiconductor Manufacturing Equipment Association (SEFA) announced on the 7th (local time) that sales of semiconductor manufacturing devices in Japan will reach 4.283 trillion yen this year, up 17% from last year. This is the third consecutive year of increase, and the figure has been revised upward from the forecast of 3.55 trillion yen as of January this year.

SEFA predicted that active investment in logic and foundation, which has continued since 2019, will expand further after 22 years. He pointed out that investment is expected to increase not only in terms of increasing quantitative demand, but also in terms of evolution of performance and increasing the proportion of data centers and servers. “Semiconductors are becoming a major issue at the national level,” said Ushita Kazuo, chairman of SEFA. “It is clear that semiconductors will gradually become important and both quality and quantity will increase.” Regarding the shortage of semiconductors, Chairman Ushida expressed his perception that although the timing of resolution was not clear, it will continue for the time being.He also forecast a combined sales forecast for next year of 4.2297 trillion yen, up 5 percent from last January’s estimate. It is predicted that the forecast will increase by 5% to 4.4412 trillion yen in 2024, when the first forecast is presentedOn the 11th, the National Assembly passed the Economic Security Act, which aims to strengthen the semiconductor supply chain and develop and protect high-tech technologies. It will be implemented in phases starting next spring.According to Kyodo News, Japan’s economic security law focuses on strengthening the supply chain of important goods such as △ semiconductors △ preliminary screening of infrastructure industries in preparation for cyber attacks △ public-private cooperation for advanced technology R&D △ patent disclosure.While digitalization has been accelerated due to the lockdown measures that emerged as COVID-19 spread around the world, semiconductor supply shortages continue due to supply chain disruptions caused by the invasion of Ukraine. The growing awareness of the need to respond to the climate crisis and the active transition to electric vehicles and eco-friendly energy also suggests that demand for semiconductors will continue to increase in the future. In particular, Japan is making every effort to secure semiconductors. Until the late 1980s, Japan had invested generously in semiconductor production, overtaking the United States for more than half of its global market share. However, as the trade conflict with the U.S. intensified, Japan eventually handed over its share of the semiconductor market to South Korea, Taiwan, and China. As of 2019, Japan’s share of semiconductors fell to around 10%.

In a release on the semiconductor strategy released by Japan’s Ministry of Economy, Trade and Industry in June last year, the Japanese government issued a stern warning, saying, “Japan’s share could fall to almost 0% in the next 2030.” The remarks suggest that a sense of crisis is also rising within the government.”The semiconductor strategy is completely different from the general industrial policy of enhancing the competitiveness of domestic companies to earn foreign currency,” Kazumi Nishikawa, an official at the IT industry division, told the Financial Times. He added, “The biggest challenge is to form a consensus among people (on the importance of securing semiconductors) and to let people know that this is not entirely up to the private sector.”As a result, the Japanese government is trying to secure semiconductors through subsidies and external cooperation. In November last year, Japan succeeded in attracting TSMC, Taiwan’s No. 1 foundry company, to secure semiconductor production capacity. Instead of building a semiconductor production plant in Kumamoto Prefecture, Japan, it will provide about half of the total investment of 800 billion yen (about 7.96 trillion won).Taiwan’s TSMC announced that it will jointly build a semiconductor plant with Sony in Japan and start production in December 2024. However, there are criticisms in Japan that TSMC plants, which were attracted by giving large subsidies, have not applied the latest semiconductor technology. Semiconductors are advantageous in increasing performance because the thinner the line width of the circuit, the more devices can be integrated.Nikkei Asia noted that the circuit width of the semiconductor that the TSMC Kumamoto plant will focus on is 22 nanometers (nm, 1 billionth of a meter) or 28nm, far behind the latest 5nm process. However, 22nm and 28nm semiconductors are in high demand because they are used in various devices, including automobiles, and explained that they are a cost-effective option. After securing production facilities, Japan joined hands with the U.S. to develop advanced semiconductors. Through cooperation with the U.S., the company aims to take the lead again in developing and mass-producing advanced semiconductors that lag behind Korea and Taiwan.Japan’s Economy, Trade and Industry Minister Koichi Hagida agreed to cooperate in semiconductor research and development and strengthening supply chains in a meeting with U.S. Commerce Minister Lumondo on the 4th, Nihon Keizai (Nikkei) reported. It has decided to cooperate with the U.S. in developing high-tech semiconductors and mass-producing areas that lag behind Korea and Taiwan.Nikkei explained that the U.S. and Japan’s cooperation in the semiconductor field aims to catch up with South Korea and Taiwan in 2nm products and develop cutting-edge products that exceed 2nm first. In addition to the U.S. and Japan, the two ministers also mentioned that they share the purpose of strengthening supply chains in countries and regions that share the same intention.South Korea and Taiwan, which are already ranked first and second in the semiconductor industry, are in the process of mass production of 2nm products. Taiwan’s TSMC is preparing to mass-produce 2 products for smartphones and supercomputers, while South Korea’s Samsung Electronics is also planning to mass-produce 2nm products from 2025.In the meantime, the goal is to quickly catch up with South Korea and Taiwan by strengthening cooperation between the U.S. and Japan. IBM in the U.S. also succeeded in producing 2nm prototypes last year, and it seems that it can record high efficiency at a time when equipment companies such as Tokyo Electron and Canon in Japan are already participating in IBM’s production plan. In addition to 2nm products, Nikkei noted that Intel’s chiplet technology in the U.S., which combines multiple semiconductors to increase semiconductor performance, could be the subject of development.Still, Japanese experts remain concerned that the bureaucratic Japanese government may have entered

Sales of Japanese semiconductor manufacturing devices are expected to exceed 4 trillion yen for the first time this year.

According to foreign media such as Nikkei, the Japan Semiconductor Manufacturing Equipment Association (SEFA) announced on the 7th (local time) that sales of semiconductor manufacturing devices in Japan will reach 4.283 trillion yen this year, up 17% from last year. This is the third consecutive year of increase, and the figure has been revised upward from the forecast of 3.55 trillion yen as of January this year.

SEFA predicted that active investment in logic and foundation, which has continued since 2019, will expand further after 22 years. He pointed out that investment is expected to increase not only in terms of increasing quantitative demand, but also in terms of evolution of performance and increasing the proportion of data centers and servers. “Semiconductors are becoming a major issue at the national level,” said Ushita Kazuo, chairman of SEFA. “It is clear that semiconductors will gradually become important and both quality and quantity will increase.” Regarding the shortage of semiconductors, Chairman Ushida expressed his perception that although the timing of resolution was not clear, it will continue for the time being.

He also forecast a combined sales forecast for next year of 4.2297 trillion yen, up 5 percent from last January’s estimate.

It is predicted that the forecast will increase by 5% to 4.4412 trillion yen in 2024, when the first forecast is presentedOn the 11th, the National Assembly passed the Economic Security Act, which aims to strengthen the semiconductor supply chain and develop and protect high-tech technologies.

It will be implemented in phases starting next spring.

According to Kyodo News, Japan’s economic security law focuses on strengthening the supply chain of important goods such as *semiconductors * preliminary screening of infrastructure industries in preparation for cyber attacks * public-private cooperation for advanced technology R&D* patent disclosure.

While digitalization has been accelerated due to the lockdown measures that emerged as COVID-19 spread around the world, semiconductor supply shortages continue due to supply chain disruptions caused by the invasion of Ukraine.

The growing awareness of the need to respond to the climate crisis and the active transition to electric vehicles and eco-friendly energy also suggests that demand for semiconductors will continue to increase in the future.

In particular, Japan is making every effort to secure semiconductors.

Until the late 1980s, Japan had invested generously in semiconductor production, overtaking the United States for more than half of its global market share.

However, as the trade conflict with the U.S. intensified, Japan eventually handed over its share of the semiconductor market to South Korea, Taiwan, and China. As of 2019, Japan’s share of semiconductors fell to around 10%.

In a release on the semiconductor strategy released by Japan’s Ministry of Economy, Trade and Industry in June last year, the Japanese government issued a stern warning, saying, “Japan’s share could fall to almost 0% in the next 2030.

” The remarks suggest that a sense of crisis is also rising within the government.”The semiconductor strategy is completely different from the general industrial policy of enhancing the competitiveness of domestic companies to earn foreign currency,” Kazumi Nishikawa, an official at the IT industry division, told the Financial Times. He added, “The biggest challenge is to form a consensus among people (on the importance of securing semiconductors) and to let people know that this is not entirely up to the private sector.

“As a result, the Japanese government is trying to secure semiconductors through subsidies and external cooperation. In November last year, Japan succeeded in attracting TSMC, Taiwan’s No. 1 foundry company, to secure semiconductor production capacity.

Instead of building a semiconductor production plant in Kumamoto Prefecture, Japan, it will provide about half of the total investment of 800 billion yen (about 7.96 trillion won).Taiwan’s TSMC announced that it will jointly build a semiconductor plant with Sony in Japan and start production in December 2024. However, there are criticisms in Japan that TSMC plants, which were attracted by giving large subsidies, have not applied the latest semiconductor technology.

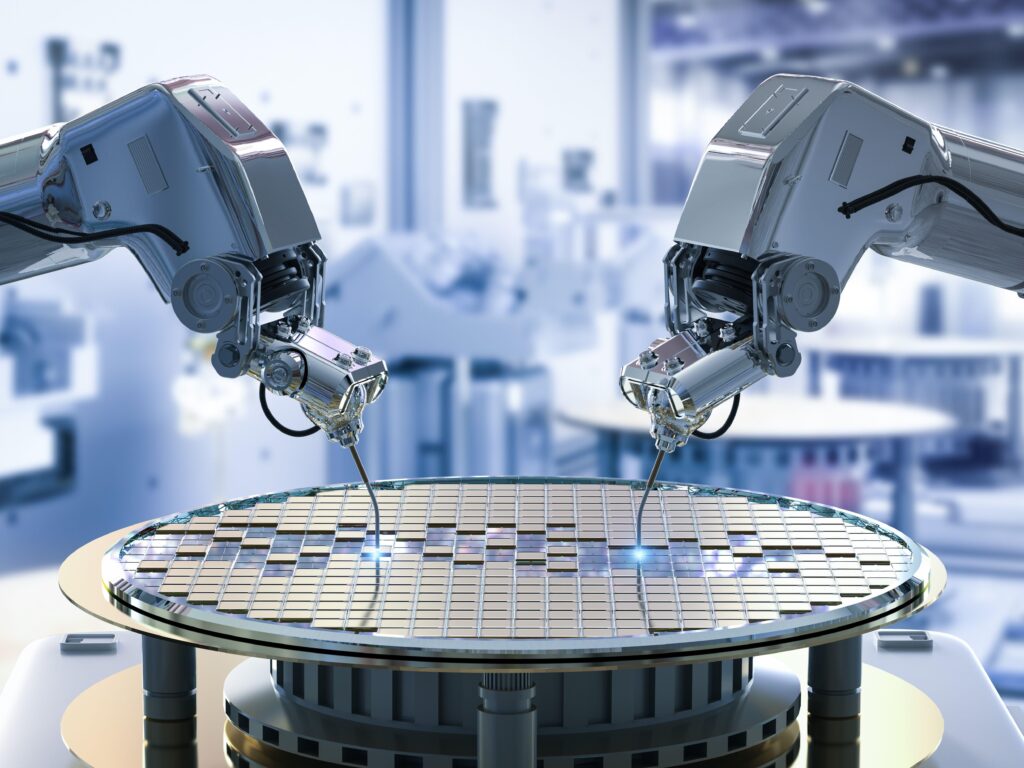

Semiconductors are advantageous in increasing performance because the thinner the line width of the circuit, the more devices can be integrated.

Nikkei Asia noted that the circuit width of the semiconductor that the TSMC Kumamoto plant will focus on is 22 nanometers (nm, 1 billionth of a meter) or 28nm, far behind the latest 5nm process. However, 22nm and 28nm semiconductors are in high demand because they are used in various devices, including automobiles, and explained that they are a cost-effective option.

After securing production facilities, Japan joined hands with the U.S. to develop advanced semiconductors.

Through cooperation with the U.S. the company aims to take the lead again in developing and mass-producing advanced semiconductors that lag behind Korea and Taiwan.

Japan’s Economy, Trade and Industry Minister Koichi Hagida agreed to cooperate in semiconductor research and development and strengthening supply chains in a meeting with U.S. Commerce.

KS Choi

ASIA JOURNAL