Hyundai Motor Group Chairman will mark the second anniversary of his inauguration on the 14th. Chairman Chung used the crisis as an opportunity as the company ranked third in global automobiles amid global supply chain chaos such as supply and demand of semiconductors. In addition, it has stepped up its capabilities such as electricity, robotics, autonomous driving, and future aviation mobility (AAM) to “First Mover.”

■ Global 3rd place…= Hyundai Motor Group sold 3,299,000 units worldwide in the first half of this year, ranking third in global automobiles after Toyota Group of Japan (5,138,000 units) and Volkswagen Group of Germany (4,006,000 units). Hyundai Motor Group has been included in the global “Big Three” list for the first time in 12 years since it beat Ford in the U.S. in 2012.

Analysts say that Chung’s strategy to respond to the supply chain crisis was right. As supply and demand of semiconductors and the situation in Russia overlapped, Hyundai Motor established a contingency plan earlier this year and set up strategies such as direct purchase of semiconductors, placement of major components in the region, and adjustment of plans to launch new cars. In particular, since Chairman Chung took office, his achievements in the electrification business have been remarkable. Hyundai’s first E-GMP (E-GMP) model, Ioniq 5, has received a number of world-class awards, including “World’s Car of the Year” (WCOTY) since its launch in 4 years last year and Kia’s EV6, which was introduced in August last year. Hyundai Motor and Kia ranked second after Tesla in the U.S. electric vehicle market, and in Europe, they ranked third except for Chinese brands, and their commercialization is also recognized by consumers.

Hyundai Motor has entered Europe and China with Genesis brands this year, and has re-entered Japan for the first time in 12 years based on Ionic 5 and NEXO, a hydrogen electric vehicle, to expand its global domain. Hyundai Motor Group has proposed a total of 3.07 million electric vehicles in 2030 to achieve a 12% share in the global electric vehicle market share. In 2025, it plans to introduce two new platforms: ‘eM’ for passenger electric vehicles and ‘eS’ for purpose-based mobility (PBV) for electric vehicles.

Earlier in April, Chairman Chung was selected as the “Prophet of the Year” among the destructive innovators of the global automobile industry by the U.S. weekly magazine Newsweek. “We were fast followers in the era of internal combustion locomotives, but in the era of electric vehicles, all companies are on the same starting line,” he said at a U.S. correspondent meeting. “We should be the first mover to lead the global electric vehicle market with overwhelming performance and value beyond competitors.”

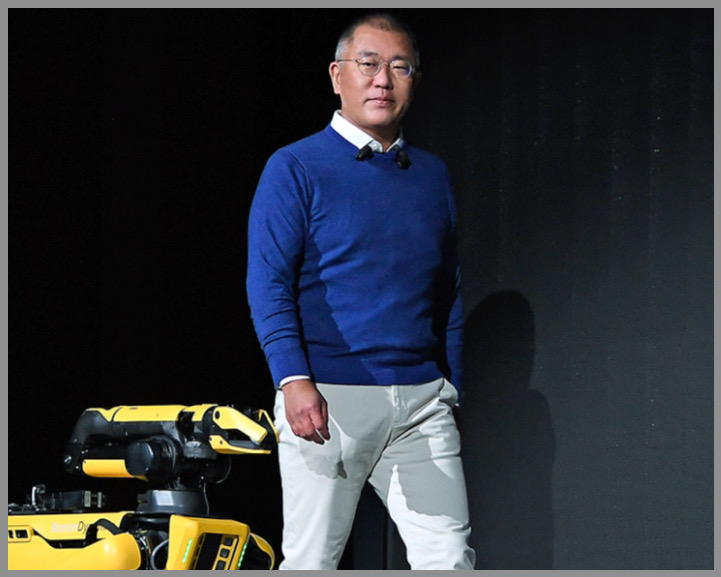

■ Robotics and all-round investment from autonomous to AAM = After taking office, Chairman Chung established the autonomous driving corporation Motual and AAM independent corporation Supernal in the U.S. and acquired Boston Dynamics, a robotics company, to strengthen future mobility capabilities. In September, Korea made all-round investments in future mobility areas, including a partnership in 6G autonomous driving technology and satellite communication-based AAM through stock exchanges worth 750 billion won with KT (Korea’s largest mobile carrier).

On top of that, Georgia, the U.S. decided to spend 55.4 trillion dollars to establish a plant exclusively for electric vehicles in the second half of 2024. Hyundai Mobis recently decided to invest 1.3 billion dollars to build an electric parts plant in the U.S. to strengthen the foundation for local electricity.

In the case of Southeast Asia, Indonesia began local production of the Ioniq 5 early this year and is building a joint battery cell plant with LG Energy Solution with the aim of completing it in the first half of next year. As Singapore plans to complete the Global Innovation Center (HMGICS), a hub for future mobility, by the end of this year, the blueprint for future mobility is expected to be more concrete.

■IRA challenges and governance restructuring are homework = However, the restructuring of governance and the breakthrough of the “Inflation Reduction Act” (IRA) implemented by the U.S. government are considered homeworks for Chairman Chung to solve in the future. Earlier, Hyundai Motor Group pushed for a governance restructuring through business reorganization of Hyundai Mobis and Hyundai Glovis in 2018, but it failed due to Elliott’s opposition. Immediately after taking office, Chung attended the second hydrogen economy committee, which was his first official event, and answered, “I am thinking about it,” when asked by reporters about re-promoting the governance structure. Since then, there has been a reorganization of affiliates such as the integration of software affiliates centered on Hyundai Autoever, but no clear change has been detected since then.

Hyundai Engineering’s listing, which was considered a key key, was withdrawn earlier this year due to poor demand forecasts, and Hyundai Mobis’ recent establishment of a subsidiary is also aimed at responding under the subcontracting law rather than reorganizing its governance structure.In addition, the IRA, which has been implemented in the U.S. since August, is an obstacle to Hyundai’s global electricity strategy. The industry interprets that domestic companies have been damaged by political logic against the IRA, but there is a possibility that it will be resolved after the U.S. midterm elections in November next month. “The IRA has a lot of political logic, so it has a lot of clunky parts. This is a violation of the Korea-U.S. free trade agreement (FTA), and it is not logical to exclude Korea, including Canada and Mexico, he said. “I think there is a possibility of a delay after the U.S. midterm elections next month.”

KS CHOI

ASIA JOURNAL