COVID-19 and K-startups

The outbreak of COVID-19 pandemic continues to hit all industries worldwide, and most devastatingly, smaller enterprises. Startups are suffering from a falling demand in the economy, as uncertainties over the global economy increase in the future. Desire for investment has quickly cooled off, and the inflow of funds was halted or delayed. Unlike large companies that utilize internal reserves or have tangible and intangible assets, it is more challenging for startups that rely on outside investment to overcome the crisis, such as the reduction of cost and manpower, on their own.

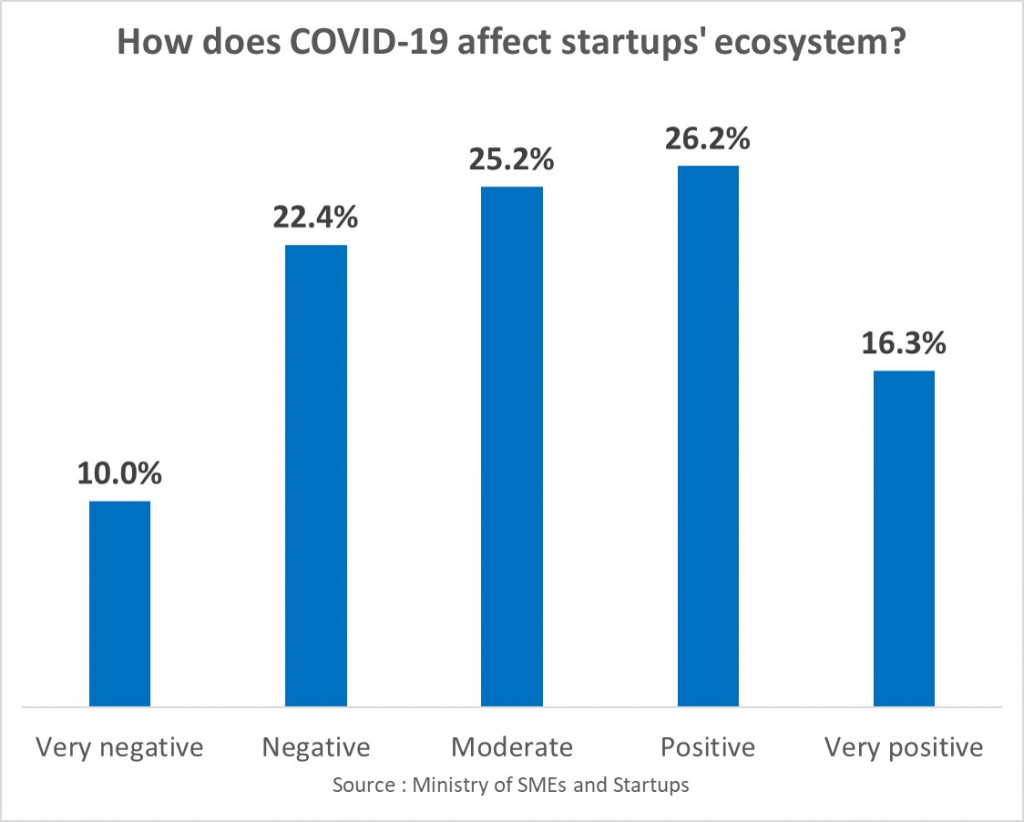

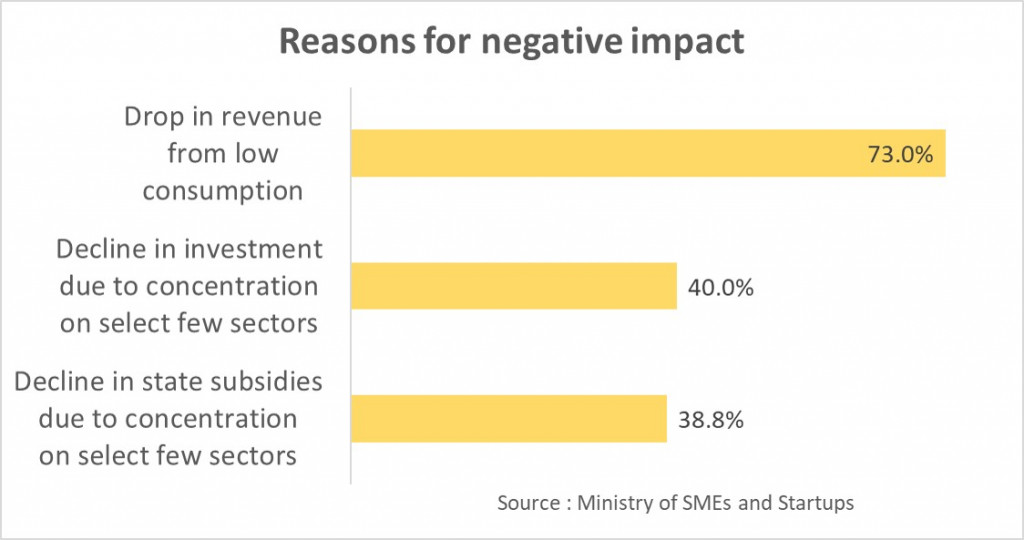

The Ministry of Small and Medium Enterprises and Startups (MSS) in South Korea released the result of a survey over South Korean startups which participated in governmental support program on May 11. Out of 492 respondents, 32.3 percent said the novel coronavirus pandemic will bring either a very negative or negative impact on the startup ecosystem. The survey showed that more than 70 percent of them worry about a revenue decline due to shrinking consumer market.

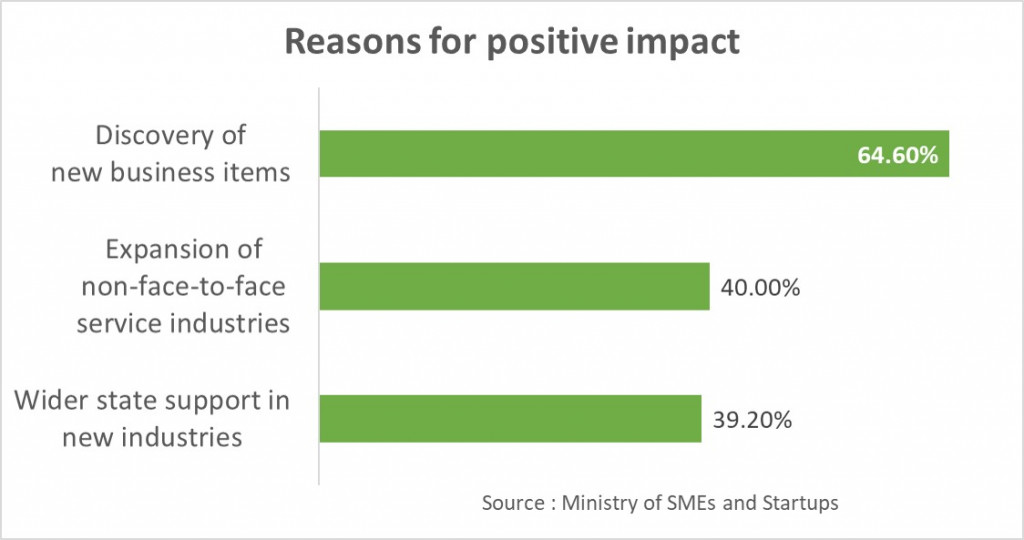

Nevertheless, 42.5 percent of 492 South Korean startups conceived the pandemic as positive for the country’s startup ecosystem in the future. Almost 65 percent of them said that there will be more chances for new business ideas due to changes derived from the pandemic, while 40 percent of the respondents also expect “untact” businesses to gain the momentum. Newly coined term ‘untact’ refers to non-face-to-face contact and has been widely used in South Korea amid social distancing.

Startups also chose medical and educational sectors as the most promising industries in post-coronavirus era on the survey. It seems due to the increasing demand on medical care and education using untact service. Venture technologies for these promising industries are drawing attention, and a completely new type of innovative services and industries are expected to come up.

Government-led support for K-startups

Seoul Start Hub

There are about 300 startup incubation centers operated by the central or local government. The Seoul, the capital of South Korea, is operating 44 of them, including Seoul Startup Hub. It roles as a control tower of incubator centers in Seoul. Each center is operated as a foothold for specific industrial sector. In a small office of about 6 to 30m²s, startups are making efforts to promote their businesses. Pangyo in Gyeonggi-do province is another hub to foster promising startups in new industries by supporting research and development, investment, and global expansion. The MSS announced another plan to construct two more ‘Startup Park’ this year. It aims to be an open innovation space where members of the startup venture ecosystem can communicate and collaborate freely.

Gyeonggi Center for Creative Economy & Innovation

The government of South Korea has also declared to focus its investment on promising industries and technologies that will lead the post-coronavirus era, including digital-based untact industries, medical and bio industries. On May 20, Minister Park Young-sun of the MSS had already stressed the government’s support for the industries at the opening ceremony of the ‘COME UP 2020’ Organizing Committee. ‘COME UP’ is Korea’s the largest government-led global startup festival, which had begun last year, and will be held in November 2020. Minister Park showed her expectation, saying that if the “COME UP” is successfully held this year, it will become a global standard of new-normal startup festival that will draw keen attention from people around the world.

Moreover, the MSS said on June 3 that it has set aside 3.7 trillion won(₩) in extra budget to turn the “crisis” into an “opportunity” for innovation. The budget plan focused on investing heavily so that innovative ventures and startups can become the world’s leading “digital power.” The MSS will also support digitalization of SMEs using Data, Network, and AI technologies. In addition, the government will increase investment in research development of human resources and new job creation in SMEs, and in establishment of response system for infectious diseases. These policies show the government’s strong willingness to overcome the global crisis derived from the pandemic and turn it into an opportunity for new industries and technologies.

From Startups to Scaleups

Last year, the number of new startups in South Korea reached a record high of 108,874. The amount of new venture investment also hit an all-time high. Seemingly, startup ecosystems are close to boom. However, if you look inside, negative statistics are being highlighted in terms of sustainability.

Recently, criticisms have been voiced in the venture industry that the government’s policy should move beyond the stage of encouraging start-ups to support “scale up.” The Organisation for Economic Co-operation and Development (OECD) defines a high-growth company, ‘a scaleup’, as a company that has achieved growth of 20% or more in either employment or turnover year on year for at least two years, with at least 10 employees in the beginning of the period. It is a concept that emphasizes ‘high growth’ rather than limited to specific industries. Scaleups role as a driving force of competitiveness and often contribute to increase aggregate productivity by ensuring coordination and upgrading of smaller suppliers.

For this reason, the proportion of high-growth companies is considered as a major evaluation indicator of the startup ecosystem. According to the Korea Institute of Science and Technology Policy on the March 10th, the proportion of high-growth companies surviving for one to three years is increasing, but the proportion of companies surviving for more than five years is not much increasing. It means that the number of startups are steadily increasing, but they remain without growing in size or disappear within five years.

The startup investment market in Korea is mainly led by the government and concentrated in certain regions, which makes difficult for the innovative ecosystem to grow. From a long-term perspective, private investment is essential for the investment ecosystem to be sustainable. According to the National Statistical Office, 62 percent of venture capital market in Korea is dependent on government funds, higher than the U.S. (17%), Britain (24%), France (45%), and Japan (36%). The government’s budget also tends to be concentrated on start-ups in the early stages, and the field of support is limited. In other words, no mid- or long-term insight or bold experimental investment is made. It only generates zombie startups, which refers to companies that live from hand to mouth with funding, keep going after funding runs out but don’t actually grow. Investors no longer see them as attractive.

Policy makers in Korea now seem to be aware of the significance of support for scaleup. The government declared that its scaleup plan on June 10th. The plan is to help SMEs, which have growth potential but are unable to issue corporate bonds on their own credit, to raise funds directly through the financial market.

Under the current situation where market functions are not working normally, the global startup ecosystem is likely to grow up completely differently depending on how governments actively support policies they will implement. It seems clear that it is time for the Korean authorities to closely examine the policies to protect the startup ecosystem and to redraw the blueprint for innovative growth led by startups after the end of the COVID-19.

Kayla Hong

Asia Journal

(Los Angeles Times Advertising Supplement)