Hyundai Motor Group on Wednesday announced long-awaited plans to overhaul its governance structure in a move to bolster future growth and shareholder value amid growing pressure from the government for the country’s leading automotive group to overhaul its complex cross-sharing holding structure by the end of this month.

As the first and major step, changes will be made to the auto group’s business structure.

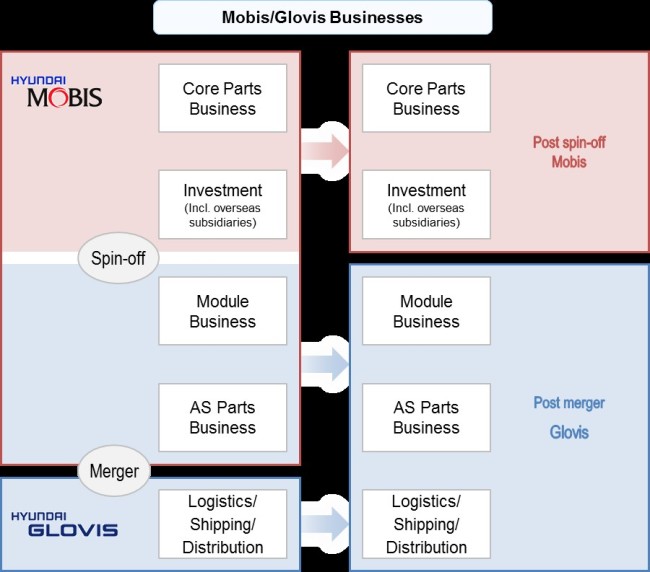

The board members of the group’s auto parts making unit Hyundai Mobis and logistics affiliate Hyundai Glovis approved spinning off Hyundai Mobis’ module and after-sales businesses, and merging them with Hyundai Glovis, said Hyundai.

|

| Hyundai and Kia Motors’ headquarters in southern Seoul. (Park Hyung-koo/ The Korea Herald) |

The distribution ratio for the spin-off merger between Hyundai Mobis and Hyundai Glovis was measured at 0.61:1 by Samil PricewaterhouseCoopers in accordance with the statutory formula set by the Financial Investment Services and Capital Markets Act of Korea.

This means for every share of Hyundai Mobis stockholders own, they would receive 0.61 new shares of Hyundai Glovis after the overhaul.

According to Hyundai, the distribution ratio factors in the intrinsic value of Hyundai Mobis’ module and after-sales businesses along with the market value of Hyundai Glovis shares.

The spin-off merger is subject to shareholders’ approval at Hyundai Mobis and Hyundai Glovis’ general meetings both scheduled on May 29.

If approved, the change will go into effect in early July, followed by modified listing of Hyundai Mobis shares and additional listing of Hyundai Glovis shares starting late July.

Following the change in business structure, Hyundai Motor Group will overhaul its complex corporate governance structure.

Board members of Kia Motors, Hyundai Glovis and Hyundai Steel would review selling each affiliate’s shares of Hyundai Mobis to Hyundai Motor Group Chairman Chung Mong-koo and Vice Chairman Chung Eui-sun.

Kia Motors currently owns 16.9 percent of shares of Hyundai Mobis, Hyundai Glovis 0.7 percent and Hyundai Steel 5.7 percent.

Chung Mong-koo and Chung Eui-sun are expected to raise funds needed to acquire shares of Hyundai Mobis by selling their Hyundai Glovis stocks among others.

Hyundai said the changes are irrelevant with hereditary succession and that Hyundai Motor Group Chairman Chung Mong-koo will retain his post as principal shareholder.

“The group’s commitment toward a more transparent and accountable governance structure will eventually benefit all stakeholders, including shareholders, employees, regulators and customers. The completion of the transactions will also effectively resolve the group’s circular shareholding structure,” Hyundai Motor Group said in a statement.

After the restructuring, Hyundai Mobis will focus on strengthening future mobility technologies in self-driving, connectivity and other future-forward growth engines, the company said.

Hyundai Glovis will add new revenue streams and growth engines on Mobis’ module and after-sales businesses.

By Kim Bo-gyung (lisakim425@heraldcorp.com)