As everyone feels, only companies with big data can make a lot of money in the 21st century. Among them, it is not only yesterday or today that the healthcare data business is attracting attention as a promising business. As the world’s fertility rate is declining and aging, the reality is that the increase in medical expenditure is inevitable. In Japan, which has aged faster than any other country, there is a company that obtains and analyzes 14 million medical information and then resells the analysis data. It is the JMDC Inc. (Japan Medical Data Center).

JMDC has 14 million insurers Database (accumulated from January 2005 to the latest), 800,000 PHR Database (in the form of a statement of insurance premiums, etc.), 551 healthcare databases (in the form of contractual healthcare institutions from April 2014), and 3,980 pharmacies Database (in recent 2years). In addition, they have 55 facilities, EMR Database (number of medical institutions that can obtain clinical test results in the form of a medical institution statement) and 482 medical papers (number of published papers using JMDC’s Database). It is the largest medical statistics data service company in Japan.

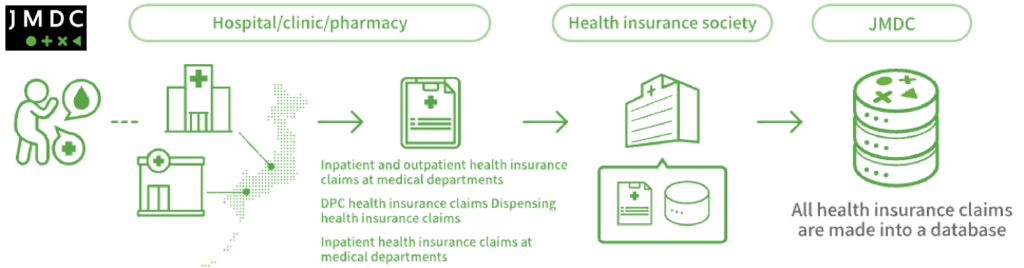

In Japan, the number of individual companies (mainly large companies) or workplace insurance associations jointly established by companies is far greater than the number of subscribers to the national health insurance. Each workplace insurance association provides JMDC with a medical expense statement and receipt submitted by the insured to claim insurance expenses. JMDC receives this and analyzes the data and suggests recommending cheaper cloned drugs or receiving treatment in advance for severe prevention. The workplace insurance association sends this information to the insured to promote the use of cloned drugs and preventive treatment. In the end, the workplace insurance association provides data to JMDC to reduce the burden of medical expenses as much as possible.

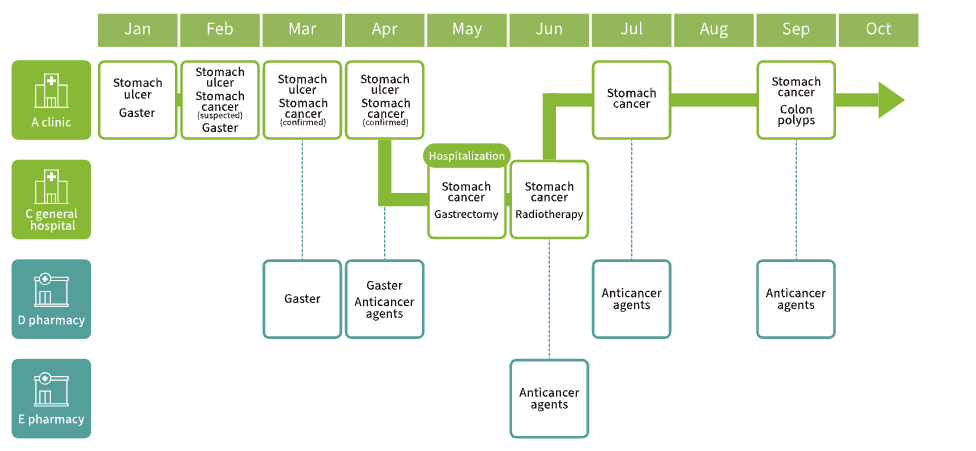

JMDC not only provides this information to insurance associations, but also sells it to research institutes and pharmaceutical companies. Of course, this information is anonymized and standardized. In this information, not only the patient’s gender, age, and disease name, but also the process of suffering from the disease can be tracked. For example, Mr. A who was diagnosed with suspected gastric cancer in January, was diagnosed with gastric cancer in March, underwent gastric cancer resection in May, and used anticancer drugs in June after receiving radiation therapy for gastric cancer. From the standpoint of research institutes and pharmaceutical companies, this information is very important in medical research and new drug development.

It’s not just this. Neo First, a subsidiary of Dai-ichi Life Insurance Company, launched a product that determines insurance premiums by the health age calculated through the analysis of JMDC’s health examination data. In other words, if you are healthier than your actual age, insurance premiums are discounted. Noritsu Koki Co., Ltd.’s insurance company in the group launched “Health Age-linked Medical Insurance” in 2016 using JMDC’s health examination results and medical bills. JMDC provides medical information to several insurance companies, and insurance companies launch products that discount insurance premiums to healthy people.

JMDC’s stock price has quadrupled since it was listed on the Tokyo Exchange in 2019. Despite the influence of COVID-19, JMDC’s annual sales are growing rapidly at 12.1 billion yen (operating profit : 5.5 billion yen) in March 2020, 16.7 billion yen (operating profit : 7.1 billion yen) in March 2021, and 21.8 billion yen (operating profit : 9.2 billion yen) in March 2022.

This may be due to the serious aging of Japan. By 2025, Japan’s Baby boomers (Dankai generation) will all be over 75 years old and enter a super-aged society.

According to the Ministry of Finance (MOF), 1.8 Japanese aged 20 to 64 are responsible for 1 Japanese aged 65 or older in 2025. In the Japanese stock market, the demand for using medical expense statements and receipts is increasing due to aging and adult diseases, and the utilization of medical big data to lower the burden of medical expenses is inevitably higher.

MIKE CHOI

ASIA JOURNAL