Last November, eight Japanese companies decided to co-establish a Japanese national semiconductor company called “Rapidus” (which means “fast” in Latin) and develop next-generation semiconductors.

Toyota (No. 1 in the world in automobiles), Kioxia (No. 3 in NAND flash semiconductors), Sony (No. 1 in image sensor), NTT (Japan’s largest telecommunications company), Softbank (Chairman Masayoshi Son’s venture investment company), and NEC (industrial computer and server company). The world’s No. 1 semiconductor company in the 1990s), Denso (automobile parts company), and Mitsubishi UFJ (Japan’s leading financial group). Japanese companies with global competitiveness formed a dream team and united for “semiconductor.”

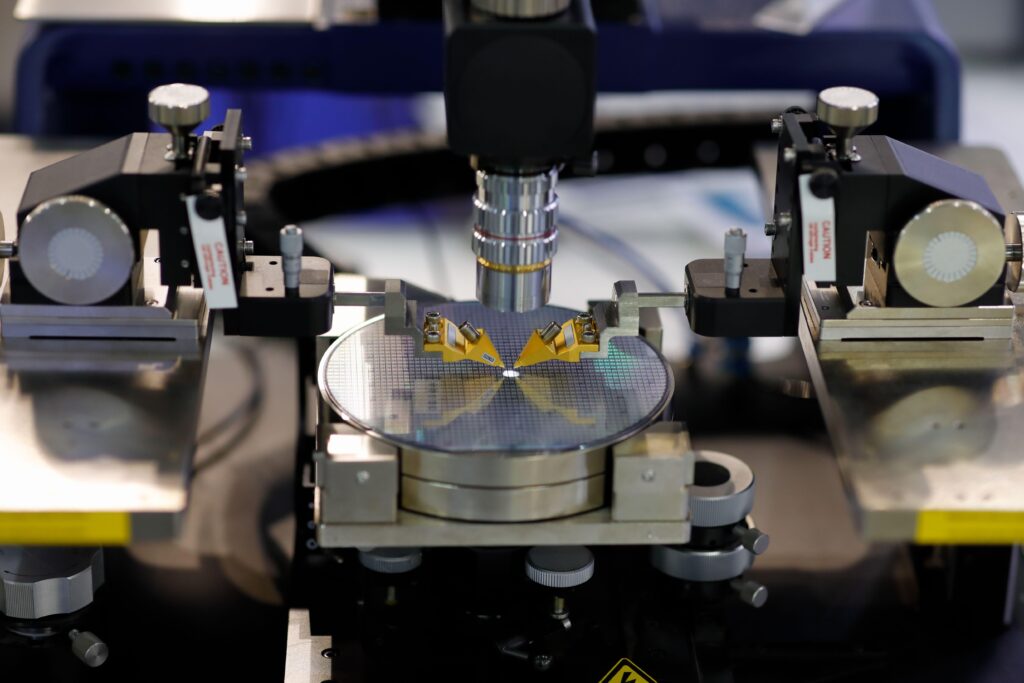

Rapidus plans to mass-produce high-tech semiconductors necessary for future technology fields such as supercomputers, smart cities, artificial intelligence (AI), and autonomous driving from 2027. In addition, Rapidus calls Japanese engineers working in Taiwan and the United States to their home countries to promote a strategy to produce semiconductors in the line width 2nm (1nm: 1 billionth of a meter). (2nm is a process that is expected to be used by world’s leading semiconductor companies such as Samsung Electronics, TSMC, and Intel from 2025.)

This is one of the government-level strategies for Japan to strengthen its semiconductor manufacturing capabilities in the mid- to long-term.

Japan, which dominated the top three semiconductors in the 1980s, including NEC, Toshiba, and Hitachi until the 1990s (at the time of 1988, Japan accounted for 50.3% of the global semiconductor market), felt that it needed its own semiconductor manufacturing capabilities after 30 years of decline. This started with Japan’s Ministry of Economy, Trade and Industry warning in a report last year that Japan’s share of the global semiconductor market will be close to “zero” by 2030.

In June 2021, Japan’s Ministry of Economy, Trade and Industry unveiled a strategy to strengthen foundry capabilities. The main point of this is to attract overseas foundries and combine them with the strengths of domestic semiconductor materials and equipment. As part of that, Japan attracted a Taiwanese foundry TSMC production line in its own country, and TSMC decided to produce factories in Kumamoto Prefecture through Japanese government subsidies and funds invested by companies such as Sony and Denso. The Japanese government has decided to invest up to 476 billion yen (about 4.5 trillion won) in TSMC, and it is moving to strengthen its semiconductor supply chain even by investing huge amounts of money.

In addition, the Japanese government announced plans to build a base for joint research and development with the United States in December. This means that Japan will learn know-how from the cooperation system with the U.S. and neighboring countries, revitalize the semiconductor industry, and prevent technology leakage, while expecting synergy between its own support policy and technology in neighboring countries.

However, there are many opinions that the biggest problem in the current Japanese semiconductor industry is a “lack of manpower.”

In an appeal to the Ministry of Economy, Trade and Industry last month, Japan’s Electronics and Information Technology Industries Association (JEITA) said, “The key is to secure enough talent to operate innovative semiconductor factories.” In particular, Hideki Wakabayashi, a professor at Tokyo University of Science and Technology, who heads the JEITA Semiconductor Policy Proposal Task Force, said, “The massive layoffs of engineers since the 2008 global financial crisis have been the starting point of the semiconductor industry’s manpower shortage.” According to data released by Japan’s Statistics Bureau, the number of semiconductor-related workers, including electronic components, devices, and circuits, stood at 240,000 last year, down 37% from 380,000 in 2010 11 years ago. “Although the global semiconductor industry has doubled by mid-2010, Japan has been different from other countries in terms of investment and employment,” said Kazuma Inoue, a consultant at Recruit. “It is currently difficult to find semiconductor experts in Japan despite active investment support from large companies such as Toshiba and Sony.”

With major global competitors such as the U.S., South Korea, China, Taiwan, and Europe making massive investments to foster the semiconductor industry, it is worth noting whether Japan will be able to rebuild its former semiconductor kingdom.

MIKE CHOI

ASIA JOURNAL