The Supreme Court has ruled against President Joe Biden’s federal student loan forgiveness plan, delivering a significant setback to borrowers who were promised loan forgiveness. The 6-3 majority decision stated that at least one of the six GOP-led states challenging the program had legal standing to do so. The court concluded that the President did not have the authority to instruct the Education Secretary to cancel a large amount of consumer debt without Congress’s authorization. The ruling denies millions of Americans the opportunity to have up to $20,000 of their student debt erased. The amount of federal student debt has more than tripled in the last 15 years, increasing from approximately $500 billion in 2007 to $1.6 trillion as of current. Chief Justice John Roberts, in the majority opinion for Biden v. Nebraska, expressed skepticism about the President’s plan and its potential harm to the Missouri Higher Education Loan Authority (MOHELA).

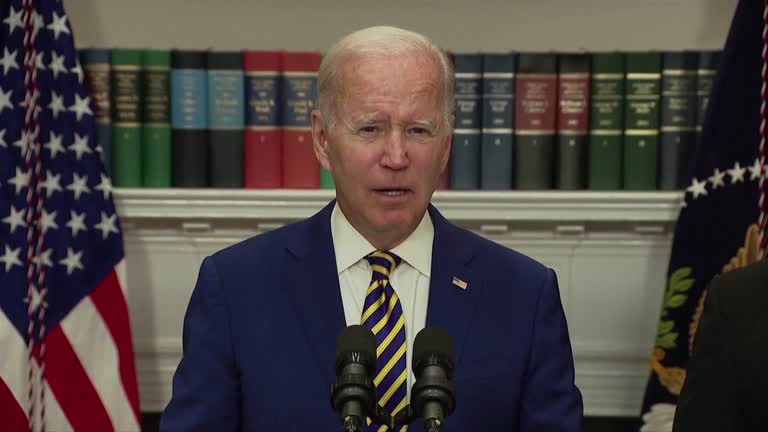

Roberts argued that the plan would have reduced profits for MOHELA and negatively impacted Missouri’s economy. However, legal experts and advocates criticized this reasoning, pointing out that MOHELA’s revenue was expected to rise due to recent departures of other student loan servicers in the industry. President Biden called the Supreme Court’s decision wrong and accused Republicans of hypocrisy, highlighting their support for pandemic-related loans to businesses while opposing relief for hard-working Americans. “Today’s decision has closed one path. Now we’re going to start another,” he said from the White House. Advocates for student loan borrowers expressed disappointment and called the ruling a betrayal, emphasizing the need for an impartial court to decide on borrowers’ financial futures. The Supreme Court’s decision is seen as a major win for plaintiffs who sought to block the forgiveness program, as they were concerned about government interference in the lending sector. Critics of Biden’s plan, which was estimated to cost $400 billion, argued that it was expensive, inflationary, and poorly targeted.

They believe the ruling puts an end to costly cancellation schemes and encourages finding alternative solutions to improve the affordability of higher education. The lack of a Supreme Court ruling until now has caused anxiety among borrowers eagerly awaiting a decision. Legal experts attribute the delay to the complexity and significance of the case, as there is no precedent for such a sweeping debt forgiveness plan. The court had to consider issues surrounding Biden’s authority, legal standing of the plaintiffs, and potential harm caused by the relief program. While borrowers hoped for a ruling before the end of the term, it is likely that the decision will be announced by early July. The justices tend to write detailed opinions in high-profile cases, aiming to demonstrate legal reasoning rather than partisan bias. However, there is a slight possibility of the court seeking further oral arguments, which would delay the final decision until the next session starting in October or later.

JULIE KIM

US ASIA JOURNAL